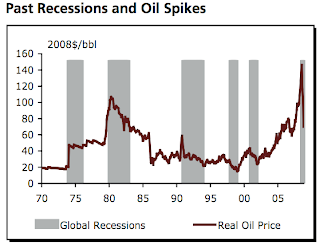

Research in the US confirms that there is a strong correlation between high oil prices and recessions. Recessions emerge when oil prices reach around $US85 a barrel (currently $US115 a barrel) or when the aggregate cost of oil for the nation equals 5.5% of GDP.

Price Tipping Point

This research lines up strongly with the analysis done for The Standard blog which shows the petrol price tipping point for New Zealand to go into recession is around $NZ 1.77 a litre (about US $85 a barrel).

"Of the 8 quarters in which petrol has averaged over $1.77, 5 were followed by a quarter of recession and the other 3 were followed quarters with 0.1% growth. Of the 17 quarters where petrol was below $1.77, the economy shrank once in the following quarter, was flat once, and grew 15 times."

$NZ1.77 a litre was the price last October, but with petrol now at $NZ 2.20 a litre and oil prices now at $US115 a barrel, the nagging question for our economy and the next recession is - (like the one posed by kids in the back seat on a road trip) - are we there yet?

A recent Bank of New Zealand weekly newsletter pointed to the impact of high fuel costs on householders -- in June 2010 the average New Zealand family spent $40.90 a week on petrol, but at $2.20 a litre the weekly expenditure rises to $53 -- a 30% increase. That’s without factoring the flow on effect of high fuel costs into freight, food, and a myriad of other oil-dependent goods and services.

Most commentators employed by the financial press or financial service firms take an optimistic view. They say it will take US$120 a barrel of oil over an extended period to cause real harm to the global economy and they point out we are nowhere near the 2008 record high of $147 a barrel. But that price was sustained for only a few days and the average price in 2008 was more akin to the prices we are seeing now. It also ignores the historical precedence (see below).

Are We De-Coupled?

The other common argument is that energy consumption/prices and economic growth can be decoupled by increasing the efficiency with which energy is used (this has occurred between 1973 and 2008, but can it be sustained ?)

A Richard Heinberg points out, this decoupling trend of the last 40 years can be explained by concealed factors.

- Efficiency gains from energy switching- eg gas to electricity- which still use the same amount of total energy

- Production has been outsourced to China and other developing nations. Such as the New Zealand derived domestic GDP growth from commerce at The Warehouse (US – WalMart), while China expended the energy producing those consumer items

- the "financialisation" of the western economies like N Z. Less manufacturing and building, but more services, lending and investing withdrawal used much less energy

When these trends are considered much of the historic evidence for energy – economy decoupling disappears.

Learn from History

Leading energy economist James Hamilton in a recent 2011paper called "Historical Oil Shocks" shows that all but one of the 11 post-war recessions - including the 2008 “Great Recession” - was associated with an increase in the price of oil. (According to Jeff Rubin the 2008 price spike, measuring from 2002 to the $147 high in 2008 was 500%+, far greater than any of the past price spikes.)

Whilst the Christchurch earthquake has been the centre of analysis of what might push New Zealand back into recession, the underlying and more severe impact of an oil shock is largely being ignored in New Zealand commentary.

And as this chart suggests New Zealand is more vulnerable to oil shocks because we rely on a greater volume of imported oil the the USA does. The impact here is more closely aligned with what has happened in Europe, Japan or other OEDC nations.

With New Zealand narrowly avoiding a double dip recession by just 0.2% and with historical evidence that there is a six -- 12 month lag between oil shocks and recessionary impact, all the evidence is pointing to New Zealand heading back into recession about right now. But it's a sure bet that the blame will be laid at the door of the Christchurch earthquake. It saves for the moment having to face up to the harsh reality of a series of recessions for which the real culprit will be oil shocks.

1 comments:

I have only just found your blog. Great to see a New Zealand commenting seriously about Peak Oil. I do not see too many people taking this seriously - especially the consequences for the global economy.

Post a Comment