By 2015 New Zealand could face an extra $10 billion cost each year to import oil, compared to 2011 prices. That's more than the cost to government of the Christchurch earthquake each and every year! By 2020 the oil import cost each year could soar to $19 billion more than the present cost. That's the bill for two Christchurch earthquakes every year.

How come?

1. Domestic oil production is plummeting

New Zealand's domestic oil production will be halved by 2015, and be almost zero by 2020. This means New Zealand's net import cost for oil will rise steeply.

It's taken an official information request (delayed for two months) to extract from government data for projected domestic oil production out to 2020. See below for the data as supplied, and a chart showing the steep decline.

Note –

1. the decline will be even sharper as the downgrade of the Tui oilfields reserves by 1/5th reported last month, has not been included.

2. Even if new oil discoveries were made offshore soon, or a lignite coal to diesel plant in Southland could be commissioned quickly (a very big "if" with severe adverse climate change effects), New Zealand's domestic oil production out to 2015 would not be increased, and it is highly unlikely any significant flows of new oil could begin by 2020, if then.

3. one petajoule equals approximately165,000 barrels of oil

2. Exchange rate forecast

Treasury's forecast for the period 2014 -- 2020 has the exchange rate trending to 0.60US$/NZ$ (BEFU -- Budget Economic and Fiscal Update

This exchange rate for 2015 -- 2020 would make oil imports significantly more expensive than the present exchange rate of 0.80 US$/NZ$.

0.60 US$/NZ$ has been used in the calculations for 2015 and 2020.

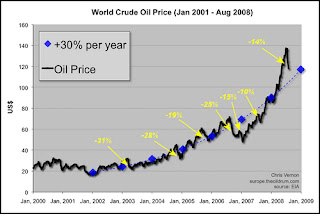

3. Oil prices forecast to rise steeply

Oil prices are forecast to be volatile but generally rise steeply in the next 5 years and beyond. Prices have risen from $US20 a barrel in 2002 to $US147 in 2008, and had been above $US100 for the last six months.

With the global economy stalling again, and the US and Europe perhaps heading back into recession, oil prices may fall again in the short term. But after the 2007-08 great recession oil prices rose quickly again, and that pattern is likely to be repeated. Many world oil experts are predicting that an oil supply crunch is looming and will rapidly push up prices in the 2012-2015 period.

The (many would say conservative) assumption used in the calculations below is that the price of oil will double to $US200 a barrel by 2015, and rise to $US250 a barrel by 2020.

Even if the exchange rate and oil price in 2015 was identical to today's rate/price, New Zealand would still face an oil import bill for an extra $1 billion a year due to our steeply declining local production.

|

| click to enlarge |

Sources

The data sources used are the official information received - see above, the New Zealand Energy Outlook 2010, New Zealand Energy Quarterly March 2011, and the International Energy Agency New Zealand Energy Review 2010.

If I have made any errors in these calculations please let me know and I'll happily amend them. They are not intended to be the last word -- obviously there are many variables. But they do show that some very big numbers are involved. As officials rightly pointed out in advice to government Ministers Joyce and Brownlee in 2009, New Zealand's oil import vulnerability and exposure economically are matters of strategic importance.

Saving is good right? So why not save oil?

All this highlights why we urgently need an adaption and conservation plan, to drastically lower our dependence on imported oil. When you see the numbers here, it just makes good common sense.

We are constantly reminded that it’s simple good practice to be thrifty and save for a home or retirement. But when it comes to saving a commodity which could add costs to our economy the equivalent of the governments funding of the Christchurch earthquake every year, we have not started to even have a discussion, let alone take decisive action. Meanwhile the UK government is developing an oil shock response plan, and in the US President Obama has agreed with the auto industry on much more stringent mandatory fuel efficiency standards.

Sadly, none of our our corporate-owned media or political leaders, are willing to confront the huge economic and social risks inherent in our oil import dependency.

1 comments:

There are a lot of assumptions in those Price and production charts. All in all New Zealand looks like it will be adversely impacted by the consequences of peak oil. Too damn cold also to grow food year round.

Post a Comment